24/9/ · What is money management in Forex? Money management Forex refers to a set of rules that help you maximise your profits, minimise your losses and grow your trading account. While it’s pretty easy to understand the benefits of these techniques, it happens that beginners to Forex trading tend to neglect even basic money management rules and end up blowing their blogger.comted Reading Time: 8 mins 5/4/ · Forex money management conclusion. Money Management is one of the most important and wide topics when it comes to successful forex trading. A famous quote says, “a bad trader will lose money with a perfect strategy, and a good trader will make money with a bad strategy.” This stands true because of the right implementation of money blogger.comted Reading Time: 8 mins Money management is the way Forex traders control their money flow: literally "IN or OUT of their pockets " Money management is simply the knowledge and skills on managing own Forex account. Forex brokers will rarely educate traders on good money management skills, though almost all brokers will offer some sort of basic tutorials, therefore it's

Money Management That Actually Works in Forex!

When trading Forex, getting the direction of the trade right is only one side of the coin, money management forex.

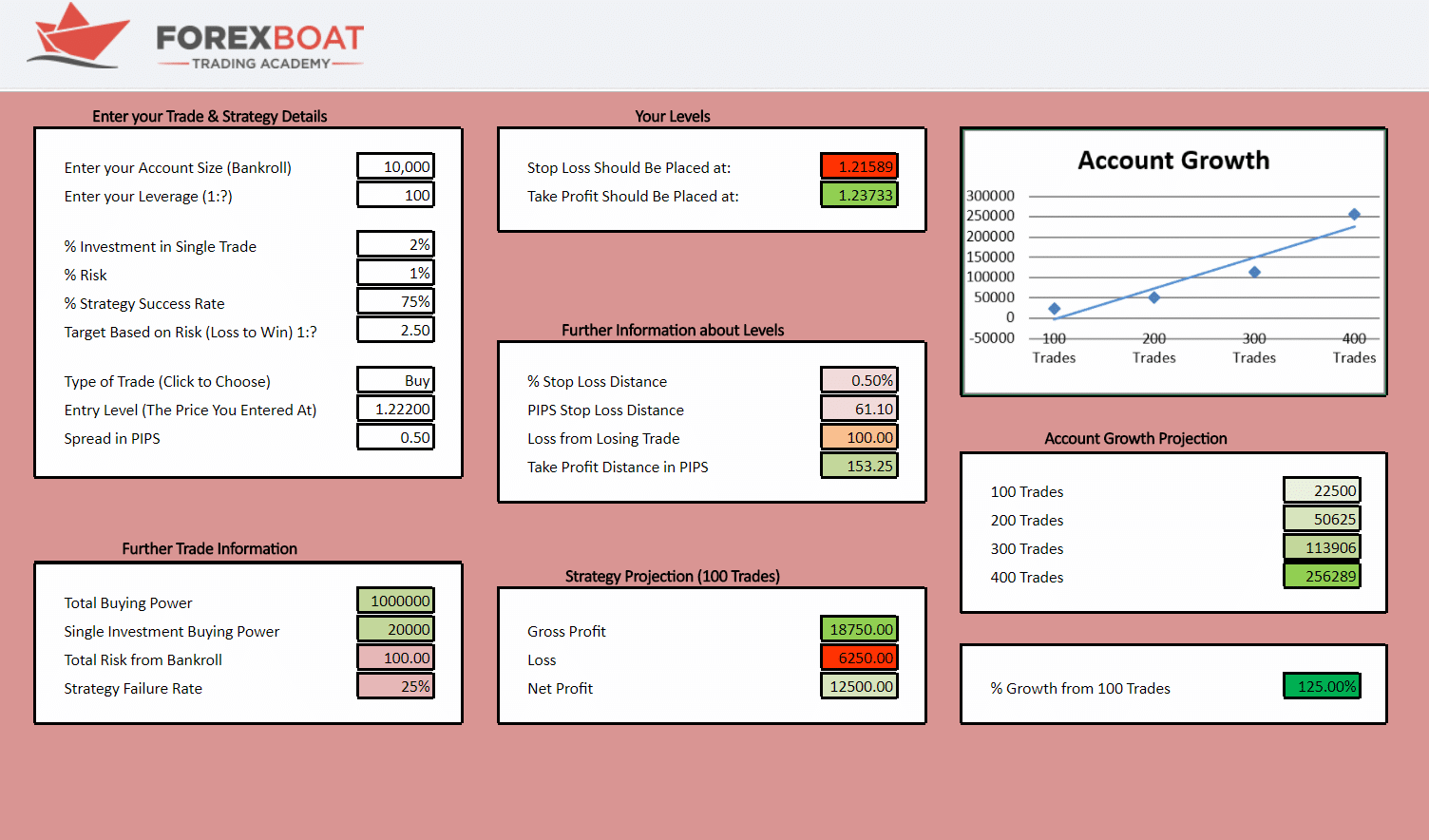

Money money management forex is the other side. Money management Forex refers to a set of rules that help you maximise your profits, minimise your losses and grow your trading account. Analysing the market and determining whether to go long or short may be difficult enough for beginner traders, money management forex, which is why I fully understand that thinking about managing your money and risk could seem boring at first.

Full stop. What do you think, money management forex, which trader will end with more profits by the end of the month? The answer is the second the trader, as the first trader will likely lose all of their profits and perhaps even more on a single losing trade.

This is why a Forex money money management forex plan helps a lot to succeed in trading. The following list is not all inclusive and there are many more rules that can be used to manage your trades and money. However, in my experience, these tend to work the best as they directly focus on the most important point — minimising your losses. New traders on the Forex market usually chase the market for trading opportunities and trade even on low-probability trade setups, ultimately ending up with a hefty loss.

Excited by the market and their first trading account, beginners will open multiple trades in a single hour, money management forex for a great profit by the end of the day. Unfortunately, money management forex, this behavior resembles more a gambler than a trader. If there are no trading opportunities, I step aside and let the market come to me in the next few days when a high-probability trade setup arises, money management forex.

Never chase the market — even a single losing trade can wipe out much of your previous profits. Another important saying in the trading community is cut the losses short and let the profits run. This refers to a straightforward principle — when a trade is losing, money management forex the trade before the losses accumulate, and when a trade is performing good, leave the trade open and have faith in your trade setup.

Inexperienced traders do it the other way around, money management forex. They leave losing trades open in the hope that they will eventually reverse, and they close a profitable trade too soon on fears that the trade may turn against them and become a losing one. Fear and greed are one of the most disastrous emotions in trading, and money management forex need to learn how to control them early in your trading career.

The most profitable traders do it the professional way — they cut their losers and let their winners run. A common mistake among beginners is trading on too much leverage. Leverage is a double-edged sword — it can magnify your profits, as well as your losses. It may be tempting to trade on large leverage and double your trading account every week, but unfortunately money management forex is not how trading works, money management forex.

The main principle that traders need to understand is that capital protection is always first. When opening a trade, think first about the downside risks and how much you could potentially lose, and only then think about the potential profits. The ideal leverage ratio is determined by a number of factors: your risk-per-trade, your typical stop-loss distance, and your trading account size.

The following two rules are critical to any Forex trader. Make sure you understand them fully before going on with the remaining money management forex. Risk-per-trade is usually determined as a percentage of your trading account size. This example shows how not to trade. The following table shows how much you need to make to return to your initial account after a series of losses.

This refers to the ratio between your maximum loss on a trade, and your maximum profit on a trade. Both categories can be simply determined by your stop-loss and take-profit levels, money management forex. Why is this so important? This is the power of reward-to-risk ratios, making it a crucial part of a well-rounded Forex trading money management system. Order types — Market order types can be used to manage your risk and improve your profitability.

Consider using stop and limit orders with predetermined stop-loss and take-profit levels to catch breakouts, and start using trailing stops to move your stop-loss with each incoming price tick that goes in your favour.

Always use stop-losses — Stop-loss orders are an important part of comprehensive Forex investment plans. In this Forex trading presentation, we mentioned stop-losses a few times as integral parts of many MM forex techniques.

Position sizing — Last but not least, position sizing is used by pro-traders to increase their profits in winning trades, money management forex, and reduce their losses on losing trades. As one of the top Forex money management strategies, position sizing works by opening additional trades in the direction of a winning trade, and closing a part of open trades when a trade is losing. The best Forex money management system needs to be a well-rounded and comprehensive system that utilizes most, if not all rules presented in this article.

A new exciting website with services that better suit your location has recently launched! Home page Getting started Articles about Forex Trading strategies 8 Forex money management tips you need to know. What is money management in Forex? Forex skills that are important for money management The following list is not all inclusive and there are many more rules that can be used to manage your trades and money.

Cut the losses short and let the profits run Another important saying in the money management forex community is cut the losses short and let the profits run.

Be cautious when trading on leverage A common mistake among beginners is trading on too much leverage. Top Forex money management rules The following two rules are critical to any Forex trader. Final Words — Forex Trading Money Management Strategies The best Forex money management system needs to be a well-rounded and comprehensive system that utilizes most, if not all rules presented in this article.

More useful articles How much money do you need to start trading Forex? What money management forex a Forex arbitrage strategy? Top 10 Forex money management tips 24 January, Alpari. Latest analytical reviews Cryptocurrencies. Oil prices gain on inventory data 4 June, EURUSD: euro tanks ahead of payrolls, Lagarde and Powell speeches 4 June, All reviews.

All categories. Trading strategies. Trader psychology. Financial market analysis.

Money Management Part 1: How to avoid the risk of losing money in forex trading

, time: 14:49Forex Money Management

24/9/ · What is money management in Forex? Money management Forex refers to a set of rules that help you maximise your profits, minimise your losses and grow your trading account. While it’s pretty easy to understand the benefits of these techniques, it happens that beginners to Forex trading tend to neglect even basic money management rules and end up blowing their blogger.comted Reading Time: 8 mins 5/4/ · Forex money management conclusion. Money Management is one of the most important and wide topics when it comes to successful forex trading. A famous quote says, “a bad trader will lose money with a perfect strategy, and a good trader will make money with a bad strategy.” This stands true because of the right implementation of money blogger.comted Reading Time: 8 mins Money management is the way Forex traders control their money flow: literally "IN or OUT of their pockets " Money management is simply the knowledge and skills on managing own Forex account. Forex brokers will rarely educate traders on good money management skills, though almost all brokers will offer some sort of basic tutorials, therefore it's

No comments:

Post a Comment